Follow Us:

P.O. Box 3, Wollaston MA 02170

Email: info@databoiler.com

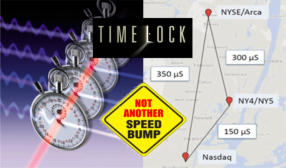

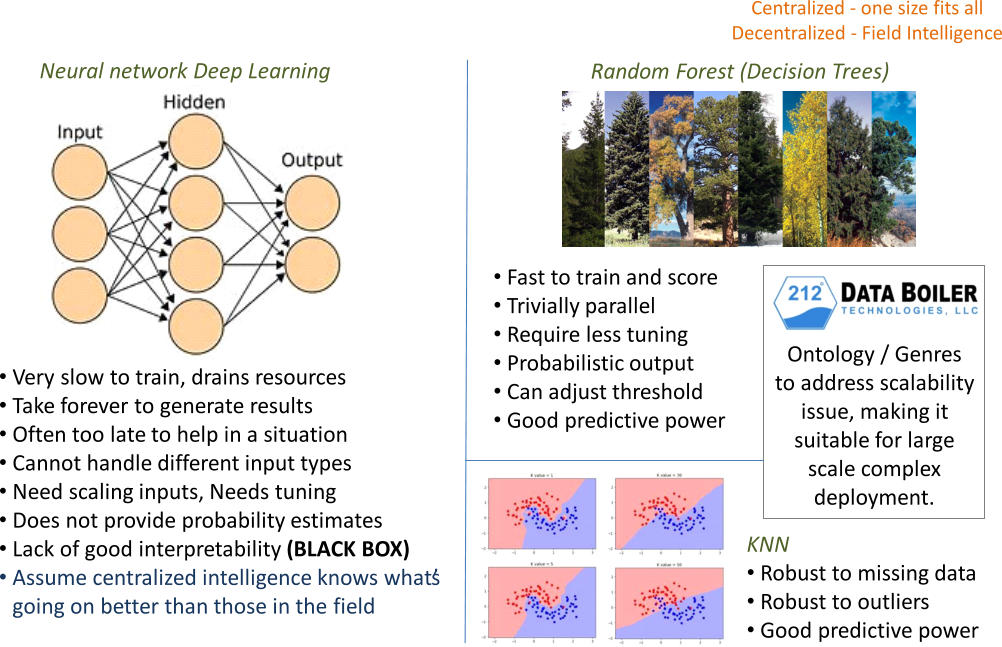

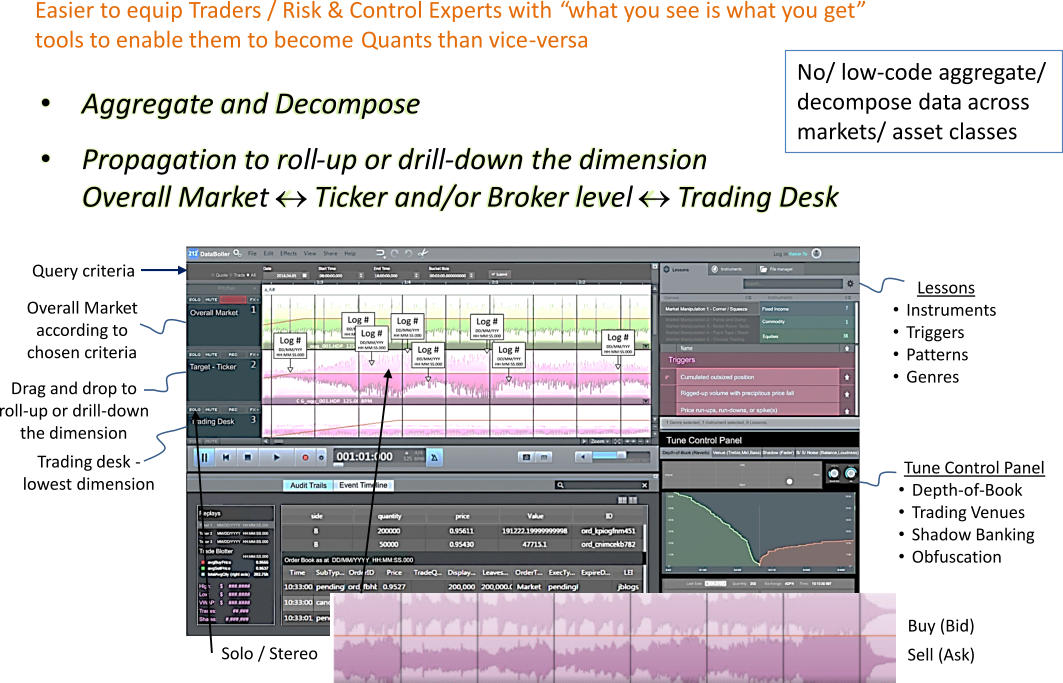

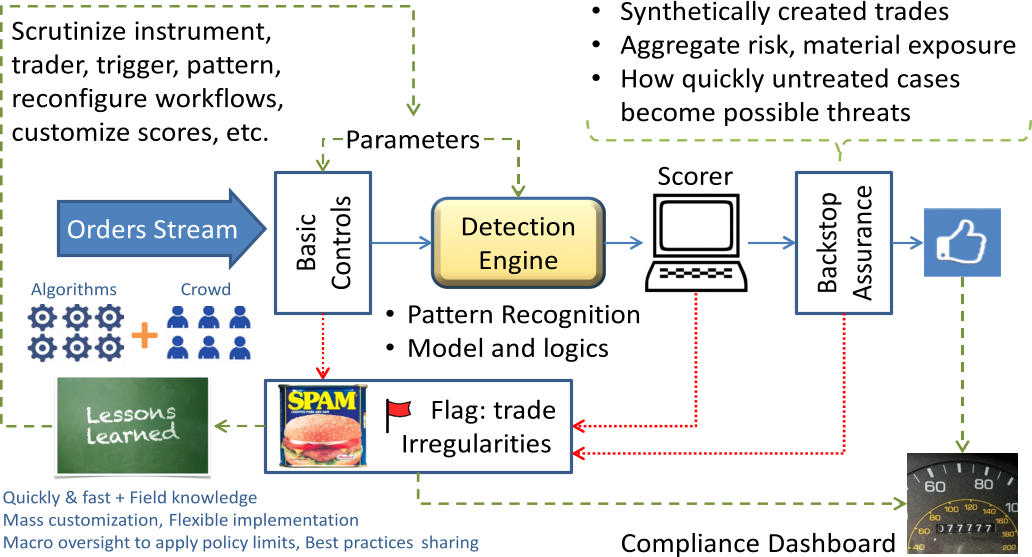

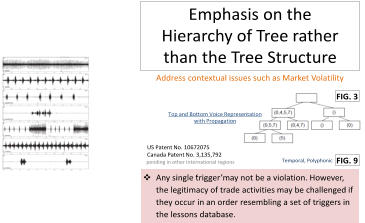

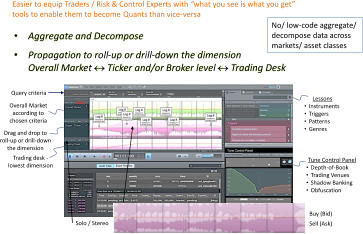

Patented solutions that crossover between music and trade provide more accurate detection of onset signals / trade

irregularities at accelerated speed and more tolerable to unsynchronized clocks/ timestamp issues + more.

•

The ONLY solution to address IOSCO - CR12/2012 challenges to effective market surveillance

•

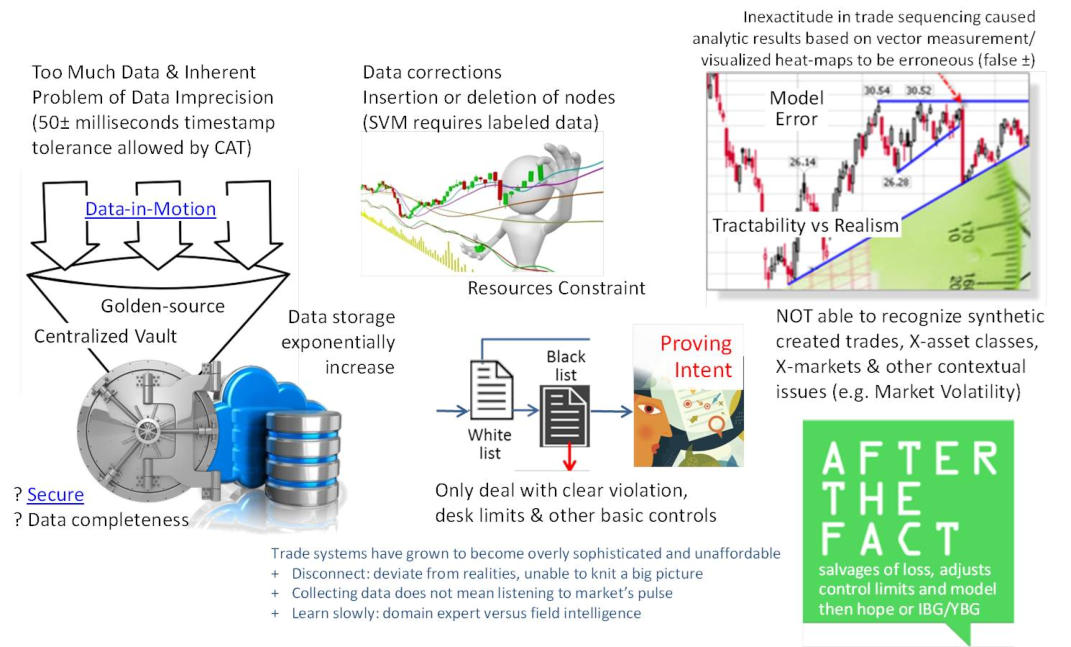

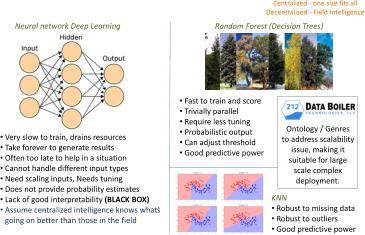

Machine learning, ontology to enable algos development and discovery of unknowns without the expensive and hard-to-learn tools

•

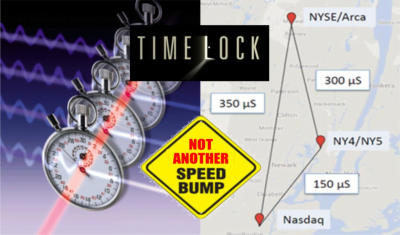

Time-lock cryptography to make market data available securely in synchronized time

Applicable to all trading desks, cross-asset classes, and markets

Our patented solution reduces data storage and boosts the efficiency in data distribution, while also enabling the replicate the depth-of-book

information (relative strengths in bid/ask price and steepness of the price curve). We acknowledge that the buy-side also wants the SIP to include all

the odd-lot details amid some hidden cost for high priced stocks. Our response is: When we are in the midst of systemic reform, asking for too much

or insisting on “complete” transparency, may indeed be detrimental to price discovery and the sustainable development of a healthy market. We do

want to strike the appropriate balance to avoid a “No fish can survive when the water is too clear” situation. Given that, we’ll preserve the richness of

contents the best we can, while making the tools fast, easy, secure, and fit for the effective monitoring of trade activities.

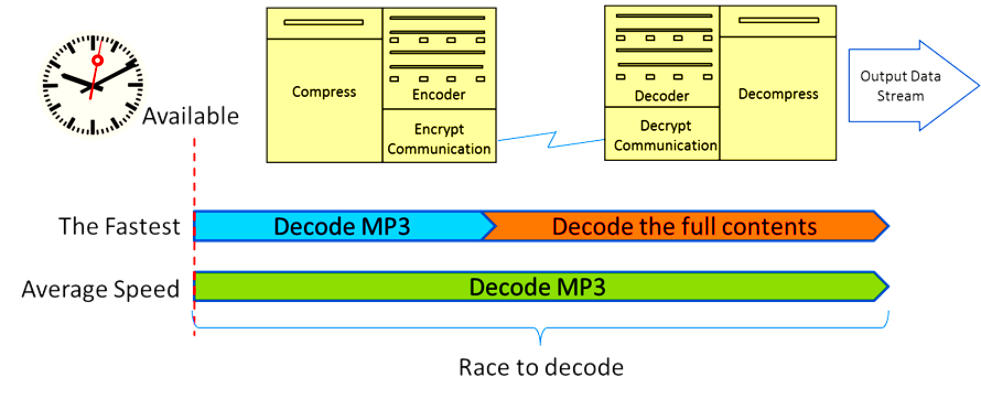

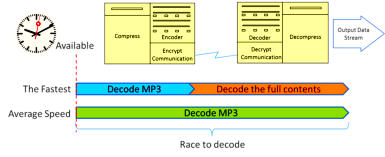

MP3 is indeed a lossy compression type, while human ears cannot distinguish almost any difference from lossless music. Lossy methods yield a

substantially greater compression ratio (60% or more of the original stream) as compared to traditional techniques (only 5-20%) that exploit statistical

redundancy, Huffman coding, or probability method to represent and compress market data.

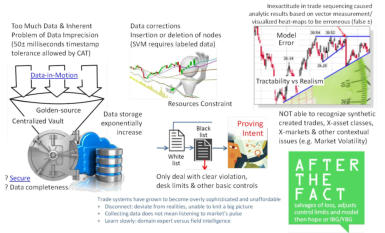

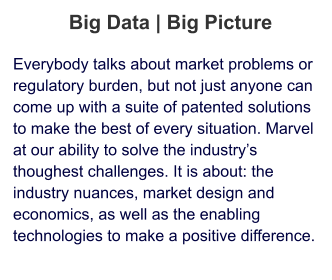

Since a thousand trades can occur between 50 +/- milliseconds, the inexactitude in trade sequencing would cause analytic results based on vector

measurements/ visualized heat-maps to be erroneous. To overcome this inherent problem of data imprecision, our suite of patented inventions

applies a “music plagiarism detection” method to achieve higher tolerance to the unsynchronized clock issue and is capable of recognizing patterns

more quickly (up to 50 milliseconds top speed, as compared to taking hours or days or even months for trade review). Aside from the accelerated

speed to decipher what’s going on in the market, it has fewer false-positives/ false-negatives than the traditional techniques. It makes

implementation of preventive controls in real- time possible; and there are other benefits such as the ease of trade reconstruction, order book replay

simulation, backstop assurance, case management capabilities, crowd computing methods, and more.

Context of the Problem

Different Learning Models

DEMO

Dectection Engine

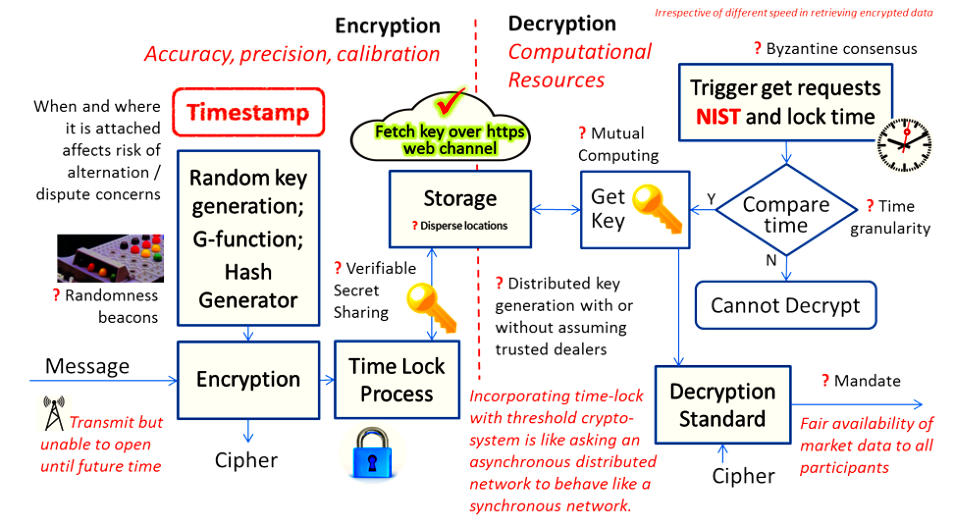

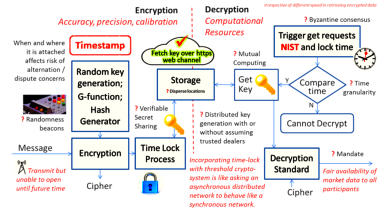

Time-lock encryption is a method to encrypt data such that it can only be decrypted after a certain deadline has passed. The goal is to protect data

from being decrypted prematurely. There are various ways to build time-lock encryption for different protection requirements. The architecture needs

precise calibration of time with an independent time aware atomic clock, such as the NIST. Besides, we don’t want to push the bottleneck to an

arms-race of using high-performing computers to decrypt data. Hence, computational resources and the type of data content must also be

considered in the design of a reliable encryption scheme.

Follow Us:

P.O. Box 3, Wollaston, MA 02170

Email: info@databoiler.com

Patented solutions that crossover

between music and trade provide more

accurate detection of onset signals /

trade irregularities at accelerated speed

and more tolerable to unsynchronized

clocks/ timestamp issues + more.

•

The ONLY solution to address IOSCO -

CR12/2012 challenges to effective market

surveillance

•

Machine learning, ontology to enable algos

development and discovery of unknowns

without the expensive and hard-to-learn tools

•

Time-lock cryptography to make market data

available securely in synchronized time

Applicable to all trading desks, cross-asset

classes, and markets

Context of the Problem

Different Learning Models

DEMO

Time-lock encryption is a method to encrypt data

such that it can only be decrypted after a certain

deadline has passed. The goal is to protect data

from being decrypted prematurely. There are

various ways to build time-lock encryption for

different protection requirements. The architecture

needs precise calibration of time with an

independent time aware atomic clock, such as the

NIST. Besides, we don’t want to push the

bottleneck to an arms-race of using high-

performing computers to decrypt data. Hence,

computational resources and the type of data

content must also be considered in the design of a

reliable encryption scheme.

Our patented solution reduces data storage and

boosts the efficiency in data distribution, while

also enabling the replicate the depth-of-book

information (relative strengths in bid/ask price

and steepness of the price curve). We

acknowledge that the buy-side also wants the

SIP to include all the odd-lot details amid some

hidden cost for high priced stocks. Our response

is: When we are in the midst of systemic reform,

asking for too much or insisting on “complete”

transparency, may indeed be detrimental to price

discovery and the sustainable development of a

healthy market. We do want to strike the

appropriate balance to avoid a “No fish can

survive when the water is too clear” situation.

Given that, we’ll preserve the richness of

contents the best we can, while making the tools

fast, easy, secure, and fit for the effective

monitoring of trade activities.

MP3 is indeed a lossy compression type, while

human ears cannot distinguish almost any

difference from lossless music. Lossy methods

yield a substantially greater compression ratio

(60% or more of the original stream) as compared

to traditional techniques (only 5-20%) that exploit

statistical redundancy, Huffman coding, or

probability method to represent and compress

market data.

Since a thousand trades can occur between 50 +/-

milliseconds, the inexactitude in trade sequencing

would cause analytic results based on vector

measurements/ visualized heat-maps to be

erroneous. To overcome this inherent problem of

data imprecision, our suite of patented inventions

applies a “music plagiarism detection” method to

achieve higher tolerance to the unsynchronized

clock issue and is capable of recognizing patterns

more quickly (up to 50 milliseconds top speed, as

compared to taking hours or days or even months

for trade review). Aside from the accelerated

speed to decipher what’s going on in the market, it

has fewer false-positives/ false-negatives than the

traditional techniques. It makes implementation of

preventive controls in real- time possible; and

there are other benefits such as the ease of trade

reconstruction, order book replay simulation,

backstop assurance, case management

capabilities, crowd computing methods, and more.