TECH INNOVATIONS

More accurate detection of onset signals / trade irregularities at accelerated speed and more tolerable to unsynchronized clocks/ timestamp issues. The ONLY solution to address IOSCO - CR12/2012 challenges to effective market surveillance. Machine learning, ontology to enable algos development and discovery of unknowns without the expensive and hard-to-learn tools. Time-lock cryptography. No/ low-code aggregate/ decompose data across markets/ asset classes + more.REGULATORY AFFAIRS

Heightened compliance burdens in the beautified name of “investor protection” may indeed be bad policies for an uneven playing field. Cross-border issues and subjective judgements lead to disputes. Cases end up in settlement without identifying the victims. Whose interest is being protected? Rights’ entitlement must accompany corresponding obligations and/or potential liabilities. Our research and outreach program answer hard questions and promote FRAND (Fair, Reasonable and Non-Discriminatory).CONSULTING + MORE

Defects, exceptions, rework are just the tip of the iceberg, troubles are hidden underneath and are overshadowed above. We are a fit- for-purpose to ease your governance, risk, and compliance burdens. Our expertise includes BCBS239, CCAR/ DFAST, FRTB, market risk, Volcker, credit risk, operational risk, cybersecurity, BCP, SCI, consolidated audit trail, 605/ 606, BestEx, MiFID II and more. You will benefit from our holistic reviews at 212° that address nuances, even across asset classes and markets.

Contact Us: 1 (617) - 237 - 6111

P.O. Box 181, Weymouth, MA 02191

Email: info@databoiler.com

Data Boiler is about:

Market Reform, GRC, FinTech Innovations. Nominated for the Best Regulatory Compliance Solution Award. We offer a suited of Patented Solutions

(18 claims in the US and Canada + more pending in the pipeline domestically and internationally). For example, using time-lock encryption to make

market data available securely in synchronized time. It addresses one of the financial industry’s toughest challenges - latency (aggregation distance/

location differential/ bandwidth) issues.

Today’s market is too fast with dynamic change, a good decision made now and pursued aggressively is substantially better than a perfect decision

made too late. A centralized vault increases cloud / data storage cost exponentially. Black box solutions take forever to train. Golden source of data is

often too late to help in a situation. Analyzing data at its source with our RTAP and ontology techniques that crossover between music and trading, is

fast to train, more tolerable to data imprecision, good predictive power, provides timely warnings, better security, and is economical to implement.

Use cases and possibilities are endless for our technologies. Whether you are discovering new ways to beat competition, enhancing execution quality,

mitigating slippage, accelerating quant development, strengthening controls for the 3 lines of defense, or improving market design, we do customize

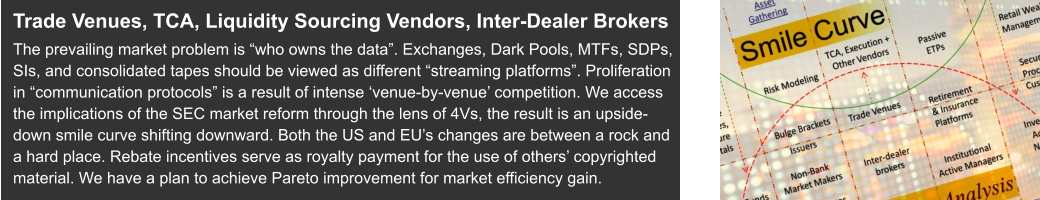

projects that fit-for-purpose. As the market is stirring up controversial discussions about Payment for Order Flow, Access Fee Rebates, BestEx, Trading

Venue Perimeter, Capital Markets Union, Wholesale Data Competition, etc., we help boil the puzzle pieces together in finding high-impact values.

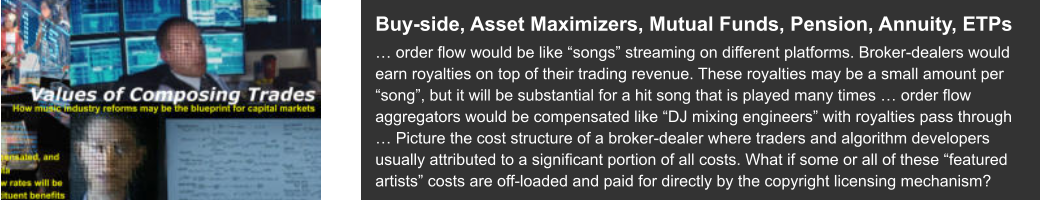

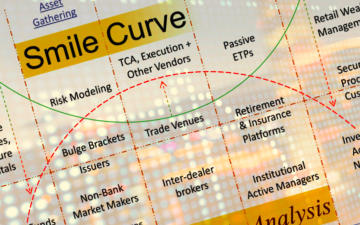

Who owns the data, what gets paid and who gets what are at the core of all these issues. Heed the lesson learnt from the music industry. Delineating

copyright and royalty payments for fair use of creative works (values of composing trades) benefits every constituent and grows the overall pie. We

lead with innovation and change to help create viable paths toward sustainable business development and economic growth.

212°

the extra degree to make

a positive difference

Why You Should Care

•

Algorithms are part of our world. Race between reverse engineering of others’ algos and preserving confidentiality. Tectonic shifts and polarizes.

•

There are values in composing trades. The music industry’s copyright mechanism has shown us a roadmap towards better outcomes for everyone.

•

You either embrace the future or face strategic challenges. We look to help revitalize the industry’s value chain and broker-dealers’ business model.

Click on the hyperlinks above and the pictures below to see how we can help

Contact Us: 1(617) - 237 - 6111

P.O. Box 181, Weymouth, MA 02191

Email: info@databoiler.com

Data Boiler is about:

Market Reform, GRC, FinTech Innovations.

Nominated for the Best Regulatory Compliance

Solution Award. We offer a suited of Patented

Solutions (18 claims in the US and Canada + more

pending in the pipeline domestically and

internationally). For example, using time-lock

encryption to make market data available securely

in synchronized time. It addresses one of the

financial industry’s toughest challenges - latency

(aggregation distance/ location differential/

bandwidth) issues.

Today’s market is too fast with dynamic change, a

good decision made now and pursued aggressively

is substantially better than a perfect decision made

too late. A centralized vault increases cloud / data

storage cost exponentially. Black box solutions take

forever to train. Golden source of data is often too

late to help in a situation. Analyzing data at its

source with our RTAP and ontology techniques that

crossover between music and trading, is fast to

train, more tolerable to data imprecision, good

predictive power, provides timely warnings, better

security, and is economical to implement.

Use cases and possibilities are endless for our

technologies. Whether you are discovering new

ways to beat competition, enhancing execution

quality, mitigating slippage, accelerating quant

development, strengthening controls for the 3 lines

of defense, or improving market design, we do

customize projects that fit-for-purpose. As the

market is stirring up controversial discussions

about Payment for Order Flow, Access Fee

Rebates, BestEx, Trading Venue Perimeter, Capital

Markets Union, Wholesale Data Competition, etc.,

we help boil the puzzle pieces together in finding

high-impact values.

Who owns the data, what gets paid and who gets

what are at the core of all these issues. Heed the

lesson learnt from the music industry. Delineating

copyright and royalty payments for fair use of

creative works (values of composing trades)

benefits every constituent and grows the overall

pie. We lead with innovation and change to help

create viable paths toward sustainable business

development and economic growth.

212°

the extra degree to make

a positive difference

Why You Should Care

•

Algorithms are part of our world. Race between

reverse engineering of others’ algos and

preserving confidentiality. Tectonic shifts and

polarizes.

•

There are values in composing trades. The

music industry’s copyright mechanism has

shown us a roadmap towards better outcomes

for everyone.

•

You either embrace the future or face strategic

challenges. We look to help revitalize the

industry’s value chain and broker-dealers’

business model.

Click on the hyperlinks above and the

pictures below to see how we can help

TECH INNOVATIONS

More accurate detection of onset signals / trade irregularities at accelerated speed and more tolerable to unsynchronized clocks/ timestamp issues. The ONLY solution to address IOSCO - CR12/2012 challenges to effective market surveillance. Machine learning, ontology to enable algos development and discovery of unknowns without the expensive and hard-to-learn tools. Time-lock cryptography. No/ low-code aggregate/ decompose data across markets/ asset classes + more.REGULATORY AFFAIRS

Heightened compliance burdens in the beautified name of “investor protection” may indeed be bad policies for an uneven playing field. Cross-border issues and subjective judgements lead to disputes. Cases end up in settlement without identifying the victims. Whose interest is being protected? Rights’ entitlement must accompany corresponding obligations and/or potential liabilities. Our research and outreach program answer hard questions and promote FRAND (Fair, Reasonable and Non-Discriminatory).CONSULTING + MORE

Defects, exceptions, rework are just the tip of the iceberg, troubles are hidden underneath and are overshadowed above. We are a fit- for-purpose to ease your governance, risk, and compliance burdens. Our expertise includes BCBS239, CCAR/ DFAST, FRTB, market risk, Volcker, credit risk, operational risk, cybersecurity, BCP, SCI, consolidated audit trail, 605/ 606, BestEx, MiFID II and more. You will benefit from our holistic reviews at 212° that address nuances, even across asset classes and markets.